11 Distance-based vehicle pricing

11.0.1 Description

Changing currently fixed vehicle fees, such as insurance premiums, registration fees and taxes, into distance-based prices by prorating them by average annual kilometers for that vehicle class. For example, for vehicles in a class that averages 10,000 annual kilometers, a $500 annual fee becomes 5₵ per kilometer and a $1,000 becomes 10₵ per kilometer.

11.0.2 Type of travel affected

This can affect most private vehicles (many commercial vehicles already have distance-based insurance pricing). This represents 80-90% of total vehicle travel.

11.0.3 How travel and emission effects can be measured and modelled

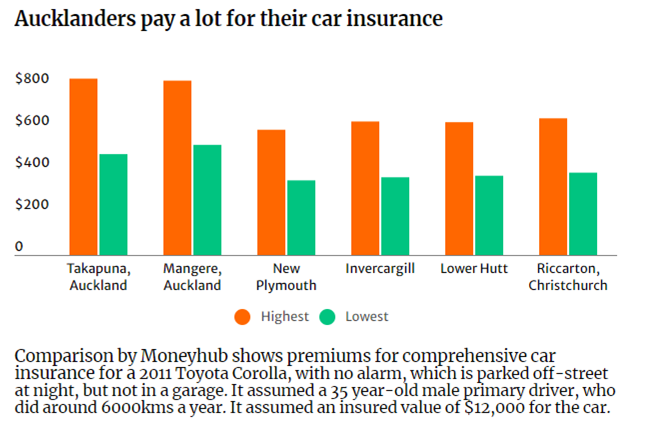

Travel impacts and emissions can be predicted based on price elasticity models. According to one source (www.stuff.co.nz/business/money/103686713/car-insurance-more-costly-for-auckland-dwellers), premiums for a typical car (a 2011 Toyota Corolla insured for $12,000 with a 35 year-old male primary driver driven 6,000 annual kilometers) range from approximately $400 to $800 per year. This would result in distance-based fees of 6.6₵ to 13.3₵ per kilometre, which is equivalent to a 20% to 40% increase in fuel prices, assuming motorists pay 32₵ per kilometer for fuel, but is not a new fee, simply a different way to pay existing fees.

www.stuff.co.nz/business/money/103686713/car-insurance-more-costly-for-auckland-dwellers

Using typical long-term fuel price elasticities of -0.6, this would reduce affected vehicles’ annual kilometers by 12% to 24%, with larger reductions by higher-risk drivers who pay higher premiums.

11.0.4 Secondary impacts

Distance-based pricing tends to increase affordability (it gives motorists a new opportunity to save money, and since vehicle travel tends to increase with income, it tends to be progressive) and equitable (prices more accurately reflect costs such as crash risk and road wear), and by reducing total vehicle travel provides many savings and benefits including reduced congestion, road and parking facility costs, and local pollution emissions. Because higher risk drivers pay higher per-kilometer premiums they are likely to reduce their mileage more than average, resulting in particularly large safety benefits.

Distance-based insurance and registrations fees could be combined with road user charges (see Road user pricing section).

11.0.5 Key Information sources

Bordoff, Jason E. and Pascal J. Noel (2008). Pay-As-You-Drive Auto Insurance: A Simple Way to Reduce Driving-Related Harms and Increase Equity. The Brookings Institution (www.brookings.edu); at https://brook.gs/3pb0qmY.

Ferreira, Joseph Jr. and Eric Minikel (2012). "Measuring Per Mile Risk for Pay-As-You-Drive Automobile Insurance" Transportation Research Record 2297. Transportation Research Board (www.trb.org) pp. 97-103; at http://pubsindex.trb.org/view.aspx?id=1129619.

Develops a model which predicts that if all Massachusetts drivers switched to per mile insurance policies aggregate vehicle miles traveled in the state would drop by 5.0% to 9.5% greenhouse gas emissions from private passenger automobiles would be reduced by a similar amount and the social equity impacts would be positive.

Greenberg, Allen and Jay Evans (2017). Comparing Greenhouse Gas Reductions and Legal Implementation Possibilities for Pay-to-Save Transportation Price-shifting Strategies and EPA’s Clean Power Plan

Litman Todd (2011) Pay-As-You-Drive Vehicle Insurance in British Columbia

Pacific Institute for Climate Solutions (www.pics.uvic.ca); at https://bit.ly/3jYF6RAhttp://www.pics.uvic.ca/assets/pdf/publications/PAYD Insurance_May2011.pdf.

Victoria Transport Policy Institute (www.vtpi.org); at www.vtpi.org/G&E_GHG.pdf; slideshow at http://bit.ly/2GwKI03.

This report evaluates the travel impacts and benefits of distance-based vehicle insurance and taxes. It concludes that these are among the most effective and by far the most cost-effective transportation emission reduction strategies considered.